|

TDHCA Texas Department of Housing and Community Affairs

Programs:

The Texas Department of Housing and Community Affairs (TDHCA) created its Texas

Mortgage Credit Certificate (MCC) Program and My First Texas Home’s "Taxable

Mortgage Program" (TMP-79) for the residents of Texas, to help make ownership of

new and existing homes more affordable for individuals and families of low and

moderate income, especially first time buyers.

Read more about the program below or use the

Lender Locator to find lenders in your

area who are currently participating in the program. The list includes address

and contact information.

Texas Mortgage Credit Certificate Program

What is a Mortgage Credit Certificate?

A Mortgage Credit Certificate allows the homebuyer to claim a tax credit for

some portion of the mortgage interest paid per year. It is a dollar for dollar

reduction against their federal tax liability.

Currently, the homebuyer can claim tax credit for 35% of the total interest paid

per year up to $2000 per year for the life of the loan.

Note: The Mortgage Interest Credit (MCC) is a non-refundable tax credit,

therefore, the Homebuyer MUST have tax liability in order to take

advantage of the tax credit.

Who is eligible to receive an MCC?

The program is open to those individuals and families who:

-

meet income

and home purchase requirements;

-

have not

owned a home as primary residence in the past three (3) years;

-

meet the

qualifying requirements of the mortgage loan;

-

will use the

home as their principal/primary residence.

Note: The MCC may not be used in connection with the refinancing of an existing

loan. Targeted Areas – first time homebuyer requirement is waived; increased

income and purchase price limits.

My First Texas Home (TMP 79)

Effective October 2012, TDHCA announced the release of $600 million in

homebuyer assistance — the largest amount

ever offered by the state — through a new mortgage-backed securities initiative

that provides qualifying borrowers a number of advantages over the Department’s

previous single family bond program.

My First Texas Home’s "Taxable Mortgage Program" (TMP-79) offers more

competitive fixed interest and annual percentage rates while providing down

payment and closing cost assistance of 5 percent of the mortgage loan.

Plus, TMP funds can be combined with the Department’s

Mortgage Credit Certificate Program,,

further increasing the home’s affordability. The program features a number of

other benefits homebuyers will find attractive; however, current eligibility

guidelines still apply.

Current Available Funds

Effective October 2012, TDHCA announced

the release of $600 million in homebuyer assistance

funds for first time homebuyers available on a first come, first served

basis. The funds will be managed through the periodic release of

Commitment Lots – each totaling approximately $35 million.

Below is a summary of approximate program

funds available as of December 21, 2012:

|

My First Texas

Home Assisted Funds Available

|

|

Remaining

|

Rate/APR

|

AMFI

|

Amt. of

Assistance

|

My First Texas Home - Program 79 -

Statewide Assisted - Commitment Lot #2† |

$24,293,246 |

3.25% / 3.434%

|

Up to 115/140% |

5% of loan amount

2nd Lien |

|

MCC Funds

Available

|

|

Remaining

|

MCC

Credit %

|

AMFI

|

Program

End Date

|

Texas Mortgage Credit Certificate Program

Non Targeted/Targeted

|

$20,000,000 |

35% |

Up to 115%/140% |

12/31/14 |

†Rates subject to

change. |

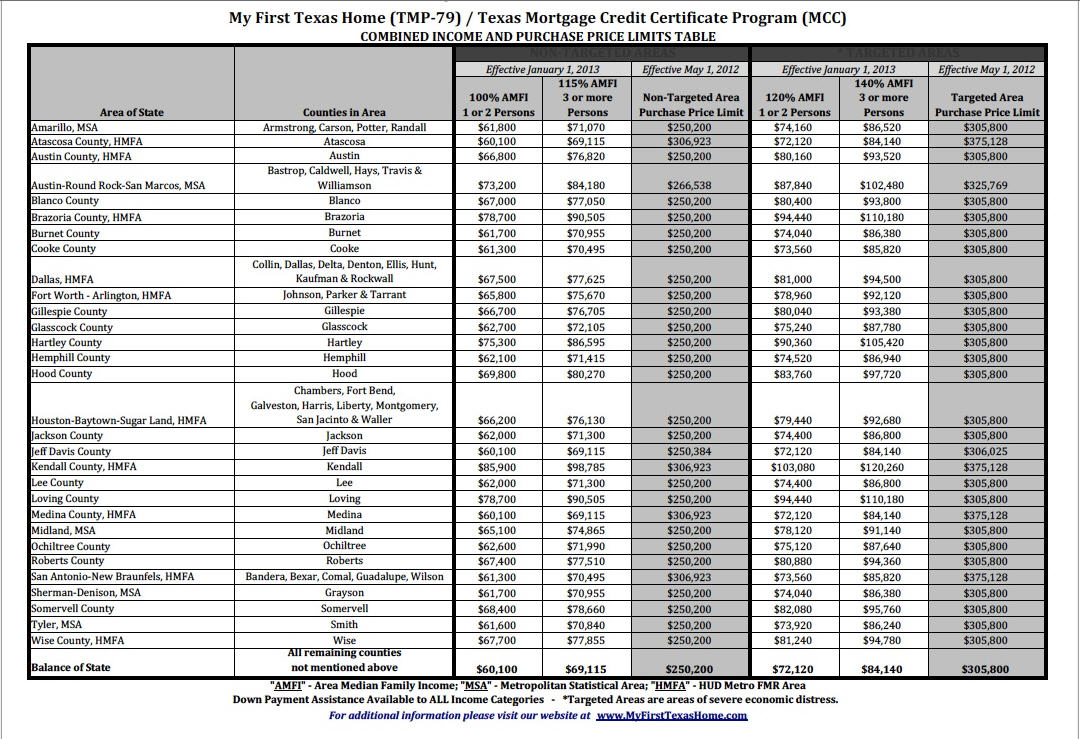

Click on the picture to view a larger size

To see complete description of these programs,

requirements, eligibilities, rules and regulations, please visit

http://www.tdhca.state.tx.us/homeownership/fthb/index.htm

To see more of other financing programs, please visit

www.TexasFiveStarRealty.com/Types_of_Loans.asp

|