Implementation of the New USDA

maps are Effective on February 2nd, 2015.

On December 16th 2014 President Barack Obama signed into law H.R. 83. The

Consolidated and Further Continuing Appropriations Act, which

provides funding for the government through September 30, 2015.

With the signing of this Act, the USDA will implement the new

eligibility maps in accordance with Farm Bill on February 2nd,

2015. The new area maps that go into effect on February 2, 2015 can

be found at the USDA eligibility website under the future eligible

areas tab USDA Future Eligible Maps.

http://eligibility.sc.egov.usda.gov/eligibility/welcomeAction.do

With

this new map there would be some towns/cities that were previously

eligible for USDA loans, but are now not eligible anymore based on

the latest census 2010. This would impact many home buyers,

especially first time home buyers and home buyers with low income.

But, current eligibility maps still are valid by or before February 2nd,

2015.

A complete package for conditional commitment must be submitted to

the USDA on or before Feb 2nd, 2015 in order to fall under the

current eligible areas. Packages that are submitted to USDA

after Feb 2nd will be subject to the new “Future Eligible Areas”.

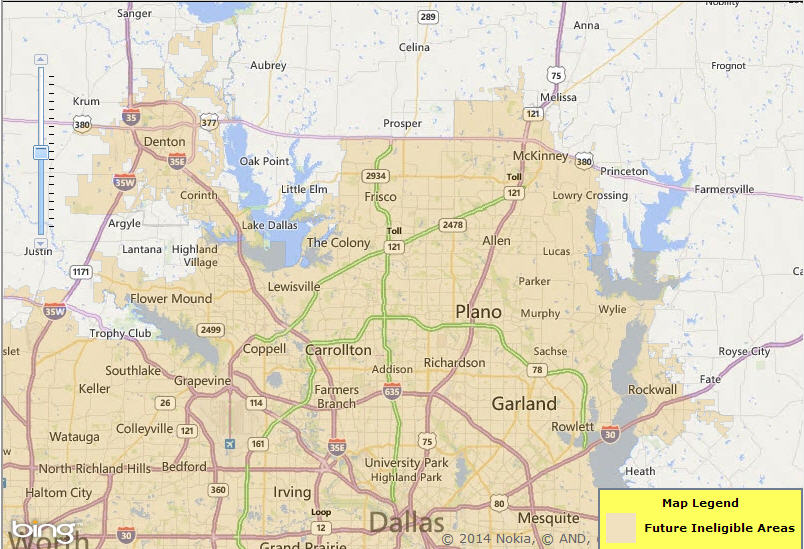

Below, you will find a future eligibility map for Dallas Forth Worth

area in Texas.

Some of the USDA eligible locations in Dallas Forth Worth area

around Collin

County, Denton County are:

Heath, Princeton, Fate, Rose City,

Farmersville, Melissa, Anna, Prosper, Celina, Little Elm, Oak Point,

Aubrey, Lantana, Argyle, Trophy Club, Krum, and …

What is USDA loan?

The USDA

Guaranteed Loan Program is a federal program offered

through the United States Department of Agriculture. Rural Housing

through the USDA program provides a number of homeownership

opportunities to rural Americans, as well as programs for home

renovation and repair. This is an excellent product and benefit for

those individuals that qualify.

What are USDA Advantages?

There are several advantages to using USDA's Home Loan Program.

·

USDA 100% Financing

·

Low Monthly Mortgage Insurance (MI) with a USDA loan

·

Low USDA Mortgage Interest Rates

·

USDA Low Closing Costs

·

USDA Zero Down Payment.

·

Easy Credit Qualifying with USDA

·

Government Guaranteed Mortgage

What Are USDA Eligibilities?

Rural Housing also offers 100% financing opportunities for those who

qualify. In order to be eligible for many USDA loans, household

income must meet certain guidelines. Also, the home to be purchased

or served must be located in an eligible rural area as defined by

USDA. This typically covers towns with less than 10,000 populations.

USDA Property Eligibility Info

Basically, the USDA home loan program has 2 things it looks at when

determining property eligibility:

(1) Location

(2) Physical Properties of the house.

Location Eligibility:

Determining the location eligibility is simple. Just

click here and use this tool to

determine if your area is eligible. Simply click on your State, the

whatever County your looking in. This will bring up a color coded

map. The areas shaded in "orange" are ineligible, all other areas

are O.K. It's that simple!

Physical Properties:

·

Single family homes only (no multi-units homes)

·

Condos/Townhomes OK

·

Home

must be in working order (no "fixer uppers" with mechanical issues)

·

No

mobile homes

·

Swimming pools cannot be used to determine the value of the home

·

An

FHA appraisal will be used

·

Basically, standard homes in working order is what's expected...this

is NOT a "fixer upper" program.

USDA Home Loan Income Limits

Rather than loan limits, USDA has implemented income limits. These

limits are generous as they are 115% of the moderate income level

for the household size of the County your buying in.

Like all home loans, your income will determine what size loan

amount you can qualify for.

Click here to use USDA's income chart. Select your State, then

Pick the County you're buying, then fill the form in underneath the

column that reflects your household size. Use the largest income

number on the chart.

Note: Regardless of who will be on the loan, ALL household income

for ALL adults must be considered.

For more information about USDA loan, USDA Property Eligibility,

Household income requirements and USDA Home Loan Income Limits

please see USDA website at:

http://eligibility.sc.egov.usda.gov/eligibility/welcomeAction.do?NavKey=home@1

You may also see this article at:

http://www.texasfivestarrealty.com/New_USDA_Map_Effective_February_2015.asp

Contact Bahman Davani at: http://www.texasfivestarrealty.com/Contactus.asp

|