1%

Increase in Interest Rate will decrease your Buying Power by 11.22%

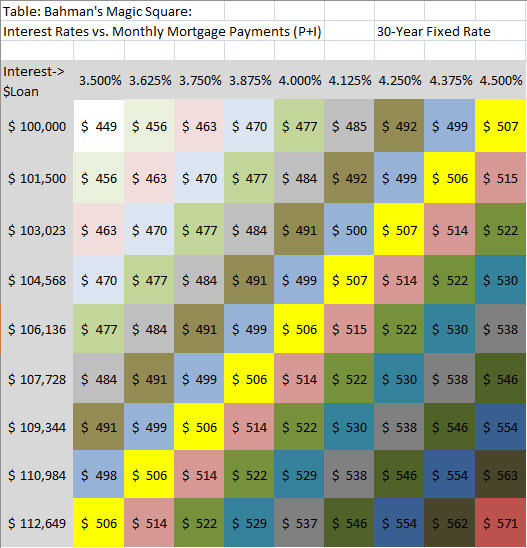

Monthly Mortgage Payments are directly impacted by the Interest

Rates. It means the higher interest rate, the higher monthly

mortgage payment (Principal + Interest) and vice versa. I have

created the following Table, Called it Bahman’s Magic Square, that

shows the monthly mortgage payments (P + I) for different interest

rates and different loan amounts.

Each Column represents Interest Rate, 3.5% - 4.5% increased by 1/8%.

e.g., 3.500%, 3.625%, etc.

Each Row represents the Loan Amount from $100,000 to $112,650

increased by 1.5%. e.g., $100,000, $101,500; etc.

Each Cell shows the Monthly Mortgage Payment for a given Loan amount

and given Interest Rate. E.g., Monthly Payment for a loan of

$100,000 and Interest Rate of 3.5% is $449.04, (Round-off $449),

etc.

Interesting enough, you can see all left-to-right diagonal values

(their color is the same) are the same or almost the same.

Considering rounding off, they are all the same. e.g., The Monthly

Mortgage payments for the following pair are the same ($100,000 and

4.5000%), ($101,500 and 4.375%), ($103,203 and 4.250%), ($104,568

and 4.125%), ($106,136 and 4.000%), ($107,728 and 3.875%), ($109,344

and 3.75%), ($110,984 and 3.625%), ($112649 and 3.5000%).

All the same colored cells (left-to-right diagonal values) are the

same or almost the same.

|

CONCLUSIONS: |

|

|

|

|

|

|

|

|

|

For each 1/8% Decrease in

Interest Rate, it will Increase your Buying Power 1.5% |

|

For each 1% Decrease in Interest

Rate, it will Increase your Buying Power 12% |

| |

|

|

|

|

|

|

|

|

|

|

For each 1/8% Increase in

Interest Rate, it will Decrease your Buying Power 1.48% |

|

For each 1% Increase in Interest

Rate, it will Decrease your Buying Power 11.22%

Interest rates are now in their record low, but it will not

stay like this for ever. Sooner or later in next couple of

years will increase. Remember, Your buying power, assuming

everything else stays the same, will decrease more than

11.22% of the purchase price if interest rate only increases

1%. It means if you can afford and qualify to purchase a

house today at $250,000 with 20% down and 3.5% Interest

rate, when the interest rate increases to 4.5%, you can only

afford a house at $222,000 and 20% down.

If you can afford and are qualify, take advantage of today’s

low interest rates to get more home for your money.

As Warren Buffet Said, “I would buy a home and finance it

with a 30 year mortgage; it’s a terrific deal.”

If you have credit score issues, read the following articles

to see how you can improve your score..

|

What is a credit score,

What makes up a credit score, Tips on how to improve their credit score,

What impact they have on your Interest rates & why they are important,

List of Do’s and Don’ts they should do before applying a mortgage loan, and

List of Do’s and Don’ts after being approved for a mortgage loan.

How Long Do I Have To Wait After Foreclosure or Bankruptcy