|

The

following changes to FHA Mortgage

Insurance Premiums (MIP) will take effect with

the respective case number assignment

dates, April 1st, 2013 and June 3rd,

2013. These changes are big and may

affect borrowers affordability and/or ability to qualify for

FHA financing.

NOTE:

These changes only affect FHA Loans with

case numbers assigned after April 1st,

2013 and has nothing to do with the Sales

closing date. Therefore, If you have a

FHA case number assigned on March 31st,

but the sale is closed sometimes in May

or after, these changes will not affect

your purchase.

These

MIP Rate and Duration changes

include:

FHA MIp Policy Change starting April

1, 2013

Effective with FHA case numbers assigned

on or after

April 1, 2013 FHA Mortgage Insurance

Premiums will

increase.

The increases in the

annual MIP specified in this article apply to

all mortgages insured under FHA’s Single

Family Mortgage Insurance Programs

except:

-

Streamline

refinance transactions of existing

FHA loans that were endorsed on or

before May 31, 2009 (see ML 2012-04)

For all SF Forward Streamline

Refinance transactions that are

refinancing FHA loans

endorsed

on or before May 31, 2009, the

Annual MIP will be .55% (55 bps),

regardless of the base loan amount

and the UFMIP will be decreased

to (1 bps) 0.01%

of the base loan amount.

-

Title I

(Home

Improvement Loans):

HUD "Title

I"

insures

private lenders against loss on

property improvement loans they

make. HUD does not lend money for

property improvements. Title I can

be used in connection with a 203k

Rehabilitation Mortgage. For

additional information on HUD "Title

I", please visit HUD website at

http://portal.hud.gov/hudportal/HUD?src=/program_offices/housing/sfh/title/ti_abou

-

Home

Equity Conversion Mortgages (HECM or

Reverse Mortgage)

Reverse mortgages are increasing in

popularity with seniors who have

equity in their homes and want to

supplement their income. The only

reverse mortgage insured by the U.S.

Federal Government is called a Home

Equity Conversion Mortgage or HECM,

and is only available through an FHA

approved lender.

-

Section

247 (Hawaiian Homelands)

FHA's mortgage insurance provides

opportunities to low- and

moderate-income Native Hawaiians to

purchase a home on Hawaiian home

lands. FHA insures loans made to

native Hawaiians to purchase one- to

four-family dwellings located on

Hawaiian home lands.

-

Section 248 (Indian Reservations)

A family who

purchases a home under this program

can apply for financing through a

FHA approved lending institution

such as a bank, savings and loan, or

a mortgage company. To quality, the

borrower must meet standard FHA

credit qualifications. An eligible

borrower can receive approximately

97% financing . An eligible party

can produce a gift for the down

payment. Closing cost can be

financed; covered by a gift, grant,

or secondary financing; or paid by

the seller without reduction in

value.

FHA case

numbers assigned on or after April 1,

2013 mean BIG changes for borrowers

and may affect their ability to qualify

for FHA financing. These changes

include:

|

|

|

Current MIP

Rate and Durations Up to |

New Rules effective with Case

Numbers

|

|

Item

Changing |

Current

Rules |

Up

to 3/31/2013 |

Up to

6/2/2013 |

starting 4/1/2013

|

starting 6/3/2013

|

|

|

Base Loan Amount <

$625,500 |

MIP Rate |

MIP Duration |

MIP Rate |

MIP Duration

|

|

> 15yr Term

Annual MIP

(paid Monthly with Mortgage

Payment)

MIP Duration |

|

down payment < 5.00%

|

1.25% |

Cancelled at 78%

LTV & 5 Years |

1.35%

|

Loan Term |

|

5.00%

< down

payment < 10.00% |

1.20% |

Cancelled at 78%

LTV & 5 Years

|

1.30%

|

Loan Term |

|

10.00%

< down

payment < 22% |

1.20%

|

Cancelled at 78%

LTV & 5 Years |

1.30%

|

11 Years |

|

down

payment >22.00% |

1.20% |

5 Years |

1.30% |

11 Years |

|

|

|

<

15yr Term

Annual MIP

(paid Monthly with Mortgage

Payment)

MIP Duration |

|

down payment < 10.00%

|

0.60% |

Cancelled at 78%

LTV

|

0.70%

|

Loan Term |

|

10.00% < down

payment

< 22%

|

0.35% |

Cancelled at 78%

LTV |

0.45%

|

11 Years |

|

down

payment

>

22.00% |

0.00% |

No Annual MIP |

0.45%

|

11 Years |

FHA MIp Policy Change starting June 3,

2013

Effective with FHA case numbers assigned

on or after June 3, 2013 FHA

Mortgage Insurance

Duration will change.

The changes to the

duration of the annual MIP as specified

in this article are effective for all Single

Family FHA programs for which FHA

charges an annual MIP except:

-

Title I

(Home

Improvement Loans):

HUD "Title

I"

insures

private lenders against loss on

property improvement loans they

make. HUD does not lend money for

property improvements. Title I can

be used in connection with a 203k

Rehabilitation Mortgage.

-

Home

Equity Conversion Mortgages (HECM or

Reverse Mortgage)

Reverse mortgages are increasing in

popularity with seniors who have

equity in their homes and want to

supplement their income. The only

reverse mortgage insured by the U.S.

Federal Government is called a Home

Equity Conversion Mortgage or HECM,

and is only available through an FHA

approved lender.

Impact Analysis (Example):

To better understand the impact of these

changes on a borrower, let's use an

example with following assumptions.

Let's assume a borrower is purchasing a

house for $200,000 with 3.5% down

(LTV=97.5%), and getting a 30-year fixed

FHA loan at 4%.

Today, prior to April 1st, 2013, The

Monthly MIP Rate and Duration are as

follow:

Loan Amount = $200,000 (1-.035) =

$200,000 * 0.965= $193,000, with

Monthly Principal + Interest =$921.41

Monthly MIP = (Loan Amount * MIP Rate

for 3.5% down )/12 = $200,000 * 96.5%

*1.25% /12 =

$201.04

The borrower is paying this Monthly MIP

until the loan balance <= 78% of the

original Loan Amount = .78* $193,000 =

$150,540

Using a

Mortgage

Amortization Table or Calculator, we

find out this happens after paying

Monthly Mortgage Payment (Principal +

Interest) for 124 Months (10 Years and 4

Months).

So, Total MIP the borrower pays for the

entire MIP duration would be

$201.04 * 124 = $24,928.96

After June 3rd, 2013,

The new Monthly MIP Rate and Duration

would be as follow:

Loan Amount = $200,000 (1-.035) =

$200,000 * 0.965= $193,000, with

Monthly Principal + Interest =$921.41

Monthly MIP = (Loan Amount * MIP Rate

for 3.5% down )/12 = $200,000 * 96.5%

*1.35% /12 =

$217.125

Increase Monthly MIP

In the above example, This is an

increase of

$16.09 =

$217.125 - $201.04 MIP per month.

Decrease

Affordability

In the above example,

additional Monthly MIP of $16.09

for 30 years translates into getting a

loan of

$189,630 (with 4% Interest

Rate) to have a monthly payment and

interest of $905.32 =$921.41- $16.09. If

the borrower were eligible or could

afford to purchaser a house at

$200,000 (Loan $ 193,300), Now with this

additional MIP he/she is eligible or

could afford to get

a loan for $189,630 (purchase a house

with $196,507

=$189,630/.965) to have the same Monthly

payment of Principal + Interest + MIP.

This is decrease affordability of

$3,493 (1.75%)

Increase Total Monthly MIP

The borrower will be paying this Monthly

MIP for the entire loan term which is 30

years or 360 Monthly Payments.

Therefore, Total MIP the borrower pays for the

entire MIP duration would be

$217.125 * 360 = $78,165.00

This is an increase of

$53,236.04 = $78,165.00

-$24,928.96 total MIP for the entire

loan term.

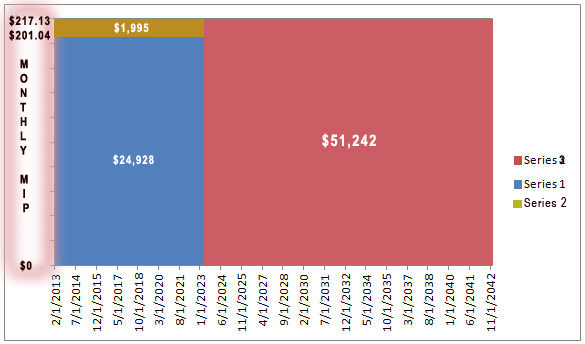

A summary of these results are shown in

Figure 1.

Assumption:

purchasing a house at $200,000 with 3.5%

down (LTV=97.5%), and getting a 30-year

fixed FHA loan at 4%.Interest Rate.

Legend:

Series 1: with FHA case numbers assigned

on or before

April 1, 2013, Total Monthly MIP

would be paid 124 Months * $201.04/Month=

$24,928

Series 1: with FHA case numbers assigned

on or before

April 1, 2013, Total Monthly MIP

would be paid 124 Months * $201.04/Month=

$24,928

Series 2: with FHA case numbers assigned

on or after

April 1, 2013, AND before June 3, 2013:

Total Additional (compare

to Series 1) MIP paid is

$ 1,995.16

= $16.09 * 124.

This

brings Total Monthly MIP to be paid

= $26,923

Series 3: with FHA case numbers assigned on or

after

June 3, 2013:

Total Additional (compare

to Series 2) MIP paid is

$51,242=

(360-124)*217.13.

This

brings Total Monthly MIP to be paid

= $78,165

For more information about these changes

and changes related to

the Base Loan Amount

>

$625,500,

please visit HUD website at

Mortgagee Letter 2013-04.

Click 2013 FHA MIP Impact Analysis Calculator to See the Affect of New

MIP Rates (April 1st, 2013) and MIP

Duration (June 3, 2013) For Different Cases

|