Credit

Score Based on Social Network Data!

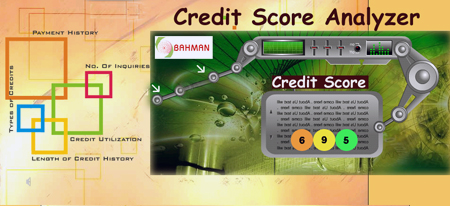

A credit score is a number which is

calculated, utilizing some sophisticated

statistical algorithms, based on your

recent (e.g., last two years or so)

payment history, history of managing

your credits and behavior of paying your

loans, credit cards, store charge cards,

bills, obligations, etc. The credit

score predicts the likelihood of a

person’s debt repayment behavior based

on the person’s recent payment history.

Figure 1: Credit Score Analyzer

There are hundreds of companies in the

U.S. and around the world that have

developed their own algorithms to

analyze different sets of data and

generate scores for different purposes.

While lenders may use different scoring

models to determine how you score, and

each major credit bureau has its own

method for calculating credit scores,

the scoring models have been fairly well

standardized so that a score at one

bureau is roughly equivalent to

the same score at another, but are not

necessarily the same.

Not all credit scores are created

equal!

The most popular Credit Scores are: FICO

Score, VantageScore, TransRisk, and Beacon score.

But, I am addressing here some of the

credit score companies which generate

your score based on the analyzing data

from social networks. These are

interesting and not many people know

about them. They are explained below.

Credit

Score Based on Social Network Data!

There are many other companies in the

U.S. and around the world that have

developed their own algorithms to

analyze different sets of data and

generate scores for different purposes.

A few interesting examples are shown

below:

Lenddo

Score: analyzing data from social

networks

(1 to 1000)

Lenddo, a Honk Kong company and other

sites like it, are analyzing data from

social networks and other factors to

reach people who have a hard time

getting loans. Lenddo focuses more on

social connections to judge the

customers trustworthiness.

Lenddo Score (1 to 1,000)

·

Number of followers

·

Background of peers

·

Education and employers

·

Repayment history of friends

Neo Finance Inc. Score: Based on actual

income and social data (LinkedIn

profile).

Neo Finance Inc., of Palo Alto, Calif.,

offers car loans to U.S. consumers based

on their actual income and social data.

Neo, which claims to save its consumers

as much 50% in interest costs, targets

young adults who may not have

comprehensive credit histories but will

likely be high earners in the future.

The company does review a user's credit

report for red flags but doesn't use the

FICO score in its risk calculation.

Instead, the company spends more time

parsing through a person's LinkedIn

profile to determine how long users have

held jobs, the number and quality of

connections in their industry and

geography and the seniority of their

connections.

The company believes: When you look at

that information you start to get a good

sense of job stability.

Affirm

Inc. Score: Based on (Gmail and

Facebook)

Affirm Inc., is a

San Francisco-based startup company.

In order to mitigate the risk of fraud,

Affirm prompts users to connect with

their Gmail or Facebook accounts, which

allow the company to verify the identity

of the user. From there, it scans a

large set of publicly available data

associated with the identity to

calculate an Affirm credit score.

"These signals help us know if you are

who you say you are," The Company says.

The company's algorithm draws on

information from more than 100 databases

and social networks, looking at an array

of variables such as the user’s

locations and the number of personal

connections.

Resources:

To get more information about credit

scores and tips and tricks on how to

improve your score, please see my book

at:

http://www.texasfivestarrealty.com/Credit_Score_Book.asp

Contact us about your Real Estate

Questions |