Closing an existing charge card can hurt your credit score

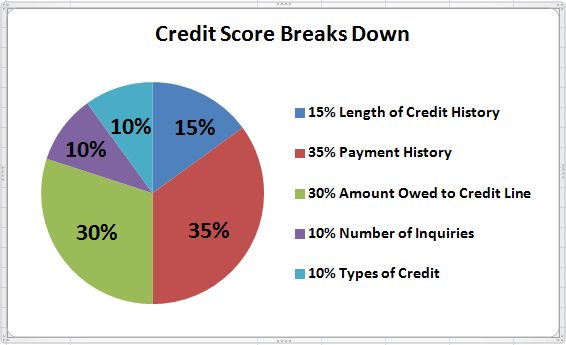

A

Credit Score is a number which is calculated, utilizing some

sophisticated statistical algorithms, based on your recent (e.g.,

last two years or so) payment history, history of managing your

credits and behavior of paying your loans, credit card, store charge

cards, and bills. The Credit Score number predicts likelihood of a

person’s behavior and paying back the loans over the near-term

future based on the person’s recent payment history.

Credit

Score makes up of the following categories with their respective

percentages:

3.

Credit History Length: 15% of your credit score

For detail information, examples, tips and tricks on how to improve

your credit score for each category please see my other article at

http://www.texasfivestarrealty.com/What_Makes_Up_a_Credit_Score_and_How_To_Improve_it.asp

However, in this article, I am focusing on effect of closing

existing credit cards on your credit score, specifically “Length

of Credit History”.

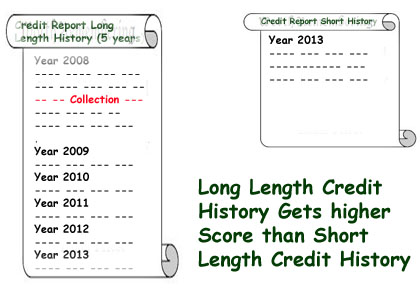

Like in statistics, test results with larger sample are more

reliable than the test results with smaller sample. A person with 20

years of credit history gets much higher score than a person with 6

months of credit history.

Remember,

positive information about your open accounts remains on your credit

report indefinitely, therefore you don’t want to lose this important

information.

TIPS:

As you see on previous example, don’t close your “OLD” credit cards,

especially if they are no-fee credit cards.

Some creditors will close your account if you don’t use them for a

while. Don’t let it happens to you. Use the following tips to avoid

closing your cards

·

Use your cards time-by-time and pay your balances in full after

receiving your bills. This builds your credit history and credit

length.

·

If for some reasons, you don’t want to use a card or currently have

no use for it (e.g., you have a department store charge card with

long history but you are not shopping there now) do the following:

TRICKS

o

Make a small purchase, e.g., $12.78, wait until you get your bill,

pay the rounded amount e.g., $13.00 either by check or online. This

causes your balance become a positive (credit) of 22¢ (22 Cents).

Remember, as long as you have credit in your balance, they cannot

close your account right away.

Some banks or credit card companies do not let you pay online more

than your current balance, then follow the following steps:

o

Either pay them by check (rounded to the next dollar) OR

o

About 1 week prior to your billing cycle, make a small purchase of

an item but don’t use it. When your bills come which includes your

last purchase, pay the full balance. Then, wait a couple of days

after they receive your payment, return the unused merchandise you

bought it last. This will show as an credit in your next bill and

sub-sequent bills.

Conclusion:

Don’t close your credit cards with substantial length of credit history.

For other tips and tricks on how to improve your credit score,

please see

http://www.texasfivestarrealty.com/What_Makes_Up_a_Credit_Score_and_How_To_Improve_it.asp

|