Why is a Credit

Score So Important?

Part 18:

As part of series of articles (blogs)

regarding Credit and Credit Score, here we

go:

Disclaimer:

Disclaimer:

Every effort has been made to make these

articles as complete and as accurate as

possible, but no warranty or fitness is implied.

The information provided is on an “as is” basis.

The author shall have neither liability nor

responsibility to any person or entity with

respect to any loss or damages arising from the

information contained in this book.

The author is not engaged in professional

services. If professional advice or other expert

assistance is required, the services of a

competent professional person should be sought.

Why is a Credit

Score Important?

In today’s tough economic times, where every

person is being evaluated and judged by a number

(credit score), having a good credit score is

essential to enjoy an appropriate standard of

living. You need to have good credit just to

rent an apartment, rent a car, open a bank

account, get insurance, get a job, buy a car or

obtain a home mortgage. Depending on your

credit, you will be denied a loan, offered a

normal rate, or offered a higher than normal

interest rate, or required to put more money

down, etc. Just a few points on your score can

be the difference between getting a home or auto

loan, or even a credit card. Similar to most

cases in finance, those considered “low risks”

get to pay the lowest rates.

To mortgage lenders, your credit score

represents your likelihood of making on-time

mortgage payment for the next couple of years.

Therefore, it is very important to have a

good/excellent credit history and credit score.

You also need to know what is in your credit

reports and what your credit score is.

Credit scores play a major role in determining

which mortgage product or loan you will qualify

for and what rate your lender will offer.

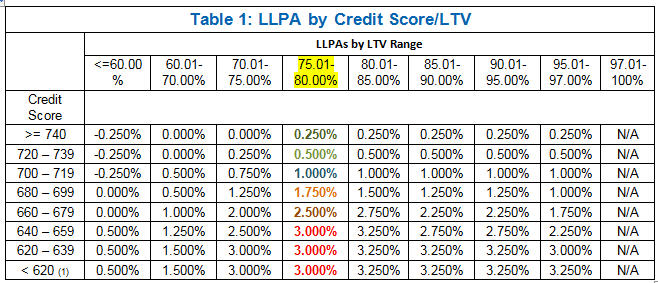

Table

1: LLPA adjustment based

on the LTV and credit score

Source:

https://www.fanniemae.com/content/pricing/llpa-matrix.pdf

Published 9/20/2012

Note: For loans with LTV > 80%, an additional

fee known as PMI (Premium Mortgage Insurance)

will be added to the Mortgage payment.

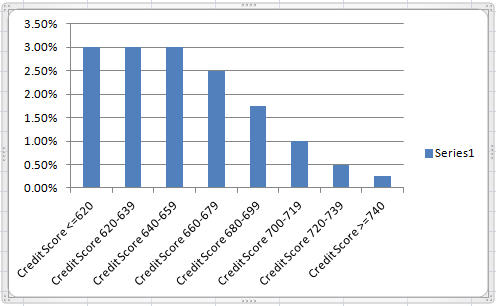

Figure

1:

Affect of FICO Score on Loan-Level Pricing

Adjustment (% of the Loan Amount)

Assuming 20% down (LTV

=80%)

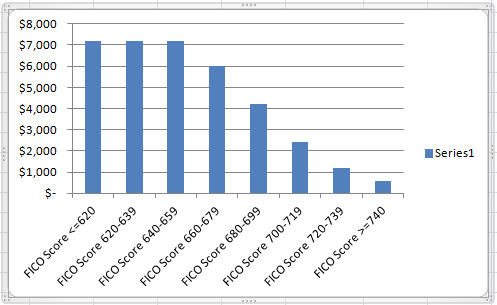

Figure

2:

Affect

of FICO Score on Loan-Level Pricing Adjustment

(Added Fee)

Assuming Purchase Price of $300,000 and 20% down

(LTV =80%)

For a given LTV (Loan-To-Value):

·

The higher your credit score, the lower your

Loan-Level Pricing Adjustments (LLPA) rate will

be.

·

The higher your credit score, the lower your

LLPA Added Fee + Mortgage Insurance will be.

·

The higher your credit score, the lower your

mortgage or interest rate will be.

Example 1:

A home purchased at $300,000 with 20% down

carries a Mortgage loan of $240,000. LLPA added

loan fees which are due at closing for borrows

with a credit score of 741 and 655 are $600 and

$7,200, respectively. As you see, the borrower

with the lower credit score of 655 will pay an

extra amount of $6,600 compared to the

borrower with credit score of 741. This shows

an example of a negative impact or cost of a low

credit score on a mortgage loan.

Example 2:

the monthly payment (Principal + Interest) of a

$250,000 loan with 30-year fixed rate of 3.5%

and 4.5% would be $1,266.71 and $1,122.61,

respectively. A 1% increase in the interest rate

in our example will cost the borrower an

additional $51,876 in his/her 30-year loan term.

Conclusion:

Credit scores play a major role in determining

which mortgage product or loan you will qualify

for and what rate your lender will offer.

The higher your credit score, the lower your

mortgage or interest rate will be.

If you plan to obtain a mortgage for your next

home purchase or buy a car, you will want to

keep your credit scores as high as possible.

You also need to know, preferably at any time,

what is in your credit reports and what your

credit score is.

By the Way, the time is 11:00 AM, do you know

what your credit score is?

HOW to overcome the problems with your credit

history and credit score?

HOW to overcome the problems with your credit

history and credit score?

Knowledge, education, awareness, practice and

discipline are the essential keys to being

successful on any subject. The book,

"Credit Score Tips and Tricks",

provides you information, tools, techniques to

educate yourself and manage your credit report &

credit score, and therefore manage your finances

effectively at no additional cost.

I have decided to bring and share with you,

chapters or sections of my book,

Credit Score Tips and Tricks,

as series of

articles here. This is the number

18 of such a

series.

I also created and manage a GROUP in ActiveRain,

Credit Reports and Credit Scores, Please

feel free to join and share your thoughts and

experiences.