What Are FICO

Score, VantageScore,

Beacon and an Empirica Score?

Part 16:

As part of series of articles (blogs)

regarding Credit and Credit Score, here we

go:

Disclaimer:

Disclaimer:

Every effort has been made to make these

articles as complete and as accurate as

possible, but no warranty or fitness is implied.

The information provided is on an “as is” basis.

The author shall have neither liability nor

responsibility to any person or entity with

respect to any loss or damages arising from the

information contained in this book.

The author is not engaged in professional

services. If professional advice or other expert

assistance is required, the services of a

competent professional person should be sought.

What Are FICO

Score, VantageScore,

Beacon and an Empirica Score?

What is a FICO Score?

FICO is named for the Fair Isaac Corporation.

FICO score analyzes a person's financial history

to derive a number showing that person’s credit

worthiness.

The Fair Isaac Corporation introduced the

formula for the FICO score in 1970. It took

almost 12 years for the founders of the company,

mathematician Earl Isaac and engineer Bill Fair,

to write the formula.

FICO score was “invented” in the 1970 and has

become the mortgage industry standard for credit

ratings. FICO score, currently, is the most

established and well-respected score among

lenders.

None of the other credit reports, however, are

particularly relevant in the home-buying

process. This is because the nation’s Mortgage

lenders rely on the FICO model.

Today, FICO score is omnipresent to the point

that people generically refer to all

credit scores as “FICO score”.

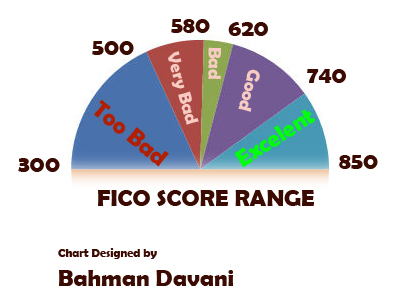

FICO score range from 300-850 and is

derived from categories shown below.

·

Length of credit history (15%)

·

Payment history (35%)

·

The Ratio of Total Debts/Total Line of available

credits (30%)

·

Number of Inquiries (10%)

·

Types of credit (10%)

What is a

VantageScore?

There are three main credit bureaus in the

United States. They are Equifax, Experian and

TransUnion. Each offers lines of credit-scoring

products, available for purchase on their

respective websites. Prices range from “free for

a short trial period” to several hundred dollars

per year.

VantageScore

was originally developed in year 2006 by the

three major nationwide credit agencies, Equifax,

Experian and TransUnion, on a range from

501-900.

There was no direct or linear translation

between VantageScore and FICO score. This has

created confusions for some consumers,

especially those who were used to FICO score on

the range of 300-850.

Finally, in March of 2013,

three main credit bureaus in the United States,

Equifax, Experian and TransUnion,

introduced VantageScore 3.0 in the direction of

making credit scores easier for consumers to

understand, as it abandoned the score range of

501-990 it has used since inception. With its

new 3.0 model, VantageScore 3.0 has adopted the

range of 300-850, making it consistent

with the score range long held by FICO scores.

VantageScore 3.0 also produces scores for

consumers who:

-

Weren’t using credit often but did use it in

the past 24 months. VantageScore

requires only one month of history and an

account reported to the agency within the

past 2 years.

-

Have no open accounts. These are often

consumers who fall into the “subprime”

category such as those who have been through

bankruptcy and subsequently stopped using

credit, or those whose only listed accounts

are collection accounts or other negative

information.

-

Show no recent activity at all on their

credit reports. The last information

reported about them may have been 3 – 4

years ago. “These consumers are relatively

good quality,” Davies notes. “71% have a

credit score of 600 or higher. They have few

delinquencies and have had accounts for a

long time but don’t use them much.”

The three credit bureaus score now on a range

from 300-850

What are a Beacon

and an Empirica Score?

Each bureau uses a different name for its score,

even if it uses the same FICO algorithm to

generate the score. For example:

- Experian uses the term "FICO or FICO II",

- TransUnion uses "Empirica"

- Equifax uses "Beacon"

Beacon score is a number generated by the

Equifax Credit Bureau to rank an individual's

credit worthiness.

Empirica score is a number generated by the

TransUnion Credit Bureau to rank an individual's

credit worthiness.

HOW to overcome the problems with your credit

history and credit score?

HOW to overcome the problems with your credit

history and credit score?

Knowledge, education, awareness, practice and

discipline are the essential keys to being

successful on any subject. The book,

"Credit Score Tips and Tricks",

provides you information, tools, techniques to

educate yourself and manage your credit report &

credit score, and therefore manage your finances

effectively at no additional cost.

I have decided to bring and share with you,

chapters or sections of my book,

Credit Score Tips and Tricks,

as series of

articles here. This is the number

16 of such a

series.

I also created and manage a GROUP in ActiveRain,

Credit Reports and Credit Scores, Please

feel free to join and share your thoughts and

experiences.