What is a Credit Score and how is Generated?

Part 15:

As part of series of articles (blogs)

regarding Credit and Credit Score, here we

go:

Disclaimer:

Disclaimer:

Every effort has been made to make these

articles as complete and as accurate as

possible, but no warranty or fitness is implied.

The information provided is on an “as is” basis.

The author shall have neither liability nor

responsibility to any person or entity with

respect to any loss or damages arising from the

information contained in this book.

The author is not engaged in professional

services. If professional advice or other expert

assistance is required, the services of a

competent professional person should be sought.

What is a Credit Score?

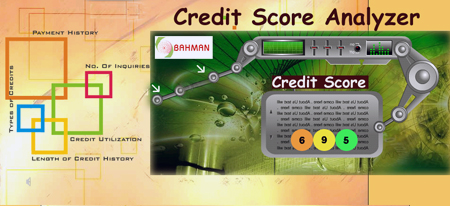

A credit score is a number which is calculated,

utilizing some sophisticated statistical

algorithms, based on your recent (e.g., last two

years or so) payment history, history of

managing your credits and behavior of paying

your loans, credit cards, store charge cards,

bills, obligations, etc. The credit score

predicts the likelihood of a person’s debt

repayment behavior based on the person’s recent

payment history.

Credit scoring can help you understand your

overall credit rating and help companies better

understand how to serve you. Overall benefits of

credit scoring have included faster credit

approvals, reduction in human error and bias,

consistency, and better terms and rates for

consumers through reduced costs and losses for

lenders.

Figure 1: Credit Score Analyzer

How Many Credit Score Companies Are There?

There are hundreds of companies in the U.S. and

around the world that have developed their own

algorithms to analyze different sets of data and

generate scores for different purposes. While

lenders may use different scoring models to

determine how you score, and each major credit

bureau has its own method for calculating credit

scores, the scoring models have been fairly well

standardized so that a score at one bureau is

roughly equivalent to the same score at

another, but are not necessarily the same.

Not all credit scores are created

equal!

In this book we only describe briefly the most

popular, FICO Score, VantageScore, Beacon score

and few interesting credit score companies.

HOW to overcome the problems with your credit

history and credit score?

HOW to overcome the problems with your credit

history and credit score?

Knowledge, education, awareness, practice and

discipline are the essential keys to being

successful on any subject. The book,

"Credit Score Tips and Tricks",

provides you information, tools, techniques to

educate yourself and manage your credit report &

credit score, and therefore manage your finances

effectively at no additional cost.

I have decided to bring and share with you,

chapters or sections of my book,

Credit Score Tips and Tricks,

as series of

articles here. This is the number

15 of such a

series.

I also created and manage a GROUP in ActiveRain,

Credit Reports and Credit Scores, Please

feel free to join and share your thoughts and

experiences.