The Ratio of Amount Owed to the Credit Line

accounts for 30% of your Credit Score. This

Ratio measures how you manage your finances and

plan for crises. Amount Owed here is not about

the dollar amount you are borrowing, it is about

the dollar amount you are borrowing relative to

the amount available to you.

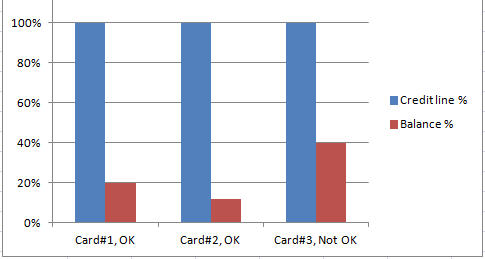

Figure

4: Ratio of Amount

Owed to Credit Line should be Less than 30 Percent

TIPS:

Keep the Ratio of Amount Owed to the Credit Line

(AO/CL) Less than 30% for each credit or charge card

individually and for all cards combined. See example

below:

|

Credit Card |

Credit Line |

Current Balance |

Amount Owed/Credit Line % |

|

Card#1 |

$5000 |

$1000 |

20% OK |

|

Card#2 |

$1000 |

$400 |

40%

Not OK |

|

Total |

$6000 |

$1400 |

23.3% OK |

1.

You should have a good cushion of available

credit between your current balance and your credit

limits on all open trades. This will have a positive

effect on your credit score. This cushion shows

lenders that you are unlikely to overextend yourself

financially.

2.

The ratio of Amount Owed to Credit Line

should be less than 33% for each credit or charge

card individually and for all cards combined. The

lesser the ratio, the better the score. For example,

carrying a $400 balance on a $1000-Limit credit card

is bad for your credit score (AO/CL=40%). Whereas,

carrying a $1000 balance on a $5000-Limit credit

card is OK for your credit score (AO/CL=20%).

3.

If you are buying a home sometime soon, don’t

be tempted to open a store charge card to receive

discounts. Though, these discounts can be huge,

sometimes up to 25% of your purchases on the first

day, usually you will be approved for a couple of

hundred dollars more than what you plan to buy. This

purchase will cause to nearly max-out your line of

credit.

For example if you plan to buy a couch that cost

about $1200, you may be awarded a credit line of

$1500, in which case your (Amount Owed)/(Credit

Line) ratio becomes 80% or about 88% including sales

tax (almost maxed-out). This will have a negative

impact on your credit score.

4.

Not all creditors, lenders, etc will send

their reports to all credit bureaus on the same day

and/or time. If you or your creditor runs your

report today at 10:00 AM, your credit reports and

credit scores could well be different than the

reports and scores if they run it a few hours later

on the same day.

Try to find out, if you can, from each of your

creditors when they send their monthly reports to

the credit bureaus. Then, plan ahead and pay as much

as possible, e.g., 1 week before the reporting day,

to reduce or pay off your balance.

5.

Time-by-time, request a soft credit line

increase. Typically, creditors can increase your

line of credit a couple of hundred or thousand

dollars without running your credit report, if you

have a good past record or relationship with them

for a year or more. If your line of credit is

increased, you’re (Amount Owed)/(Credit Line) ratio

decreases and that is good for your credit score.

HOW to overcome the problems with your credit

history and credit score?

HOW to overcome the problems with your credit

history and credit score?

Knowledge, education, awareness, practice and

discipline are the essential keys to being

successful on any subject. The book,

"Credit Score Tips and Tricks",

provides you information, tools, techniques to

educate yourself and manage your credit report &

credit score, and therefore manage your finances

effectively at no additional cost.

I have decided to bring and share with you,

chapters or sections of my book,

Credit Score Tips and Tricks,

as series of

articles here. This is the number

21 of such a

series.

I also created and manage a GROUP in ActiveRain,

Credit Reports and Credit Scores, Please

feel free to join and share your thoughts and

experiences.