Part 19:

As part of series of articles (blogs)

regarding Credit and Credit Score, here we

go:

Disclaimer:

Disclaimer:

Every effort has been made to make these

articles as complete and as accurate as

possible, but no warranty or fitness is implied.

The information provided is on an “as is” basis.

The author shall have neither liability nor

responsibility to any person or entity with

respect to any loss or damages arising from the

information contained in this book.

The author is not engaged in professional

services. If professional advice or other expert

assistance is required, the services of a

competent professional person should be sought.

For so many years it was a secret as to how

credit scores are derived or even calculated.

Though not all criteria’s and calculation

algorithms are the same for all credit scoring

companies, nor are all known even now, however

there is enough information available to show

what makes up a credit score and how much weight

each category of activity will have on the score

to come up with tips and tricks on how to

improve your score.

Account history is

deriving your credit score. Below we have

categorized account history information

according to the way it impacts your credit

score:

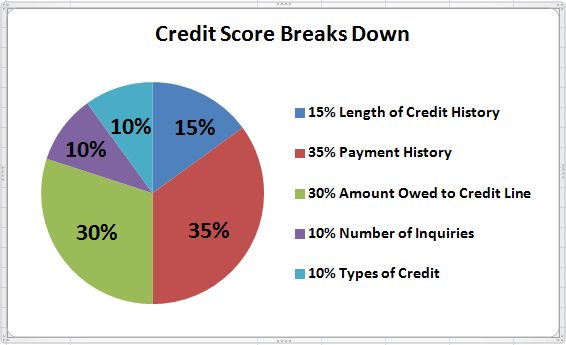

Figure 1: Credit Score

Break Down Chart

1.

Payment History: 35% of your credit score

Payment history measures how you have paid your

debts. It accounts for many factors such as:

number of times your accounts have been paid on

time, were late, have been charged off; types of

loans; etc…

·

Number of times and period of time in which you

were late for 30 days, 60 days, 90 days, or 120

days.

TIPS: A 90-day late payment has more

negative impact on your credit score than a

60-day late payment, etc.

·

Number of accounts and the amount of your

account that went to collections.

TIPS: The number of accounts in

collection (now or in the past) is more

important than the dollar amounts. For example

three accounts in collections with balances of

$1000, $450, and $120 has more negative impact

on your credit score than one account with a

$2000 balance in collection,

·

Number of accounts and credit limits of accounts

that creditors have closed your accounts,

written off or settled with less than the full

amount.

·

If you voluntarily close your account, it still

will have some negative impacts on your score.

Don’t close your account, if you don’t have to.

·

Closed accounts or settled accounts with less

than the full amounts could have a major

negative impact on your credit score, especially

with a Mortgage loan type. If it is reported

that a Mortgage loan settled with less than the

full amount, it means you had a “Short Sale”

which would have a major negative impact on your

score and lender’s decision.

TIPS:

So, if you are negotiating to pay a portion of

your debt to close the account, or you have to

go through a Short Sale or Foreclosure, make

sure to ask the creditor to (if you can) report

them in credit bureaus as “Paid in full”, “Paid

as agreed”, “Paid Satisfactory”, and/or get a

release of Judgment when applicable.

·

Types of accounts (e.g., Medical bill vs. Credit

Card charge, vs. Mortgage loan)

TIPS: Payment history of a Mortgage loan

has more of an impact than Credit Card Charges,

which in turn has more weight than Medical

Bills. For example, a $10 credit card collection

account could have more of a negative impact on

your credit score than an $800 medical

collection.

·

TIPS:

Repossession, Foreclosures and Short

Sales in Real Estate Accounts have major

negative impacts on your credit score. Try to

avoid them and work it out with lenders as much

as possible.

·

How recent the accounts were late or unpaid

(e.g., 1 month ago vs., 3 years ago)

TIPS: Please note that the recent late

accounts have more of a negative impact on your

score than an older late account, regardless of

the amount. For example, a one-dollar ($1)

60-day late fee that was reported to credit

bureaus two months ago has a much more negative

impact on your credit score than an $800, 60-day

late fee that was reported 20 months ago.

Please note that, though some of the items shown

on the previous two pages might be unrecognized

by scoring algorithms at this time, lenders and

underwriters will look at them carefully and

that information will have an impact on their

decisions.

Example of this case could be a “short sale”

scenario, in which at this time there is no

specific code or flag assigned for it in the

credit reports. However, lenders and

underwriters, by reading the comment “the

account was settled for less

than the full amount”, know it was a

“short sale” and will take necessarily actions.

HOW to overcome the problems with your credit

history and credit score?

HOW to overcome the problems with your credit

history and credit score?

Knowledge, education, awareness, practice and

discipline are the essential keys to being

successful on any subject. The book,

"Credit Score Tips and Tricks",

provides you information, tools, techniques to

educate yourself and manage your credit report &

credit score, and therefore manage your finances

effectively at no additional cost.

I have decided to bring and share with you,

chapters or sections of my book,

Credit Score Tips and Tricks,

as series of

articles here. This is the number

19 of such a

series.

I also created and manage a GROUP in ActiveRain,

Credit Reports and Credit Scores, Please

feel free to join and share your thoughts and

experiences.