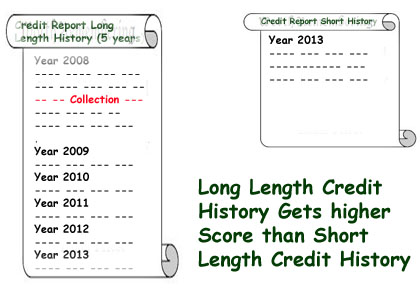

Longer Credit History Length is better than

Shorter Credit History Length for your credit

score

Part 22:

As part of series of articles (blogs)

regarding Credit and Credit Score, here we

go:

Disclaimer:

Disclaimer:

Every effort has been made to make these

articles as complete and as accurate as

possible, but no warranty or fitness is implied.

The information provided is on an “as is” basis.

The author shall have neither liability nor

responsibility to any person or entity with

respect to any loss or damages arising from the

information contained in this book.

The author is not engaged in professional

services. If professional advice or other expert

assistance is required, the services of a

competent professional person should be sought.

Like in statistics, test results with larger samples

are more reliable than the test results with smaller

samples. A person with 20 years of credit history

gets a much higher score than a person with 6 months

of credit history. Average Credit history length

will be calculated considering all loans. For

example, if you have three credit cards; Visa (20

years), MasterCard (12 years) and American Express

(1 Year), then your average credit history would be

(20+12+1)/3 = 11 Years.

TIPS:

As you can see in above example and from previous

examples, don’t close your “OLD” credit cards,

especially if they are no-fee credit cards.

Use your cards from time-to-time and pay your

balances in full. This builds credit and credit

history length. Some creditors will close your

account if you don’t use them for a while. Don’t let

this happen to you. Don’t close a card with a

substantial length of credit history.

Again, if you are buying a home sometime soon,

don’t be tempted to open a store charge card to

receive discounts. Though, these discounts can be

huge, sometimes up to 25% of your purchase’s on the

first day, this would be a new card that causes your

average history length to go down. For example, if

you already have two credit cards; Visa (20 years),

MasterCard (12 years) and you apply for a new store

charge card (0 years), your credit history length

drops from 16 years to 9.9 years. This has a

negative impact to your credit score.

TIP:

A long-length credit history, even with some

negative information, could receive higher score

than a short-length credit history with no negative

information.

HOW to overcome the problems with your credit

history and credit score?

HOW to overcome the problems with your credit

history and credit score?

Knowledge, education, awareness, practice and

discipline are the essential keys to being

successful on any subject. The book,

"Credit Score Tips and Tricks",

provides you information, tools, techniques to

educate yourself and manage your credit report &

credit score, and therefore manage your finances

effectively at no additional cost.

I have decided to bring and share with you,

chapters or sections of my book,

Credit Score Tips and Tricks,

as series of

articles here. This is the number

22 of such a

series.

I also created and manage a GROUP in ActiveRain,

Credit Reports and Credit Scores, Please

feel free to join and share your thoughts and

experiences.